The bank expected economic growth of 3.5 per cent and might have got 5 per cent. It expected unemployment of 6 per cent and got 4.2 per cent.

It has been a superb economic performance, offset by a higher than expected inflation with a headline rate of 3.5 per cent.

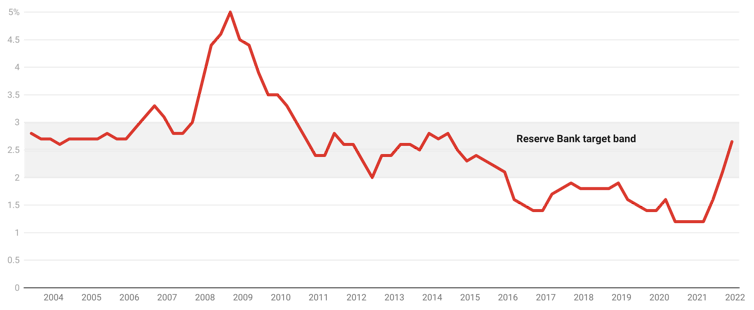

While this looks as if we might be on the road to the high inflation seen in the rest of the developed world (in the US inflation is 7 per cent), at a touch under 2.7 per cent Australia’s so-called underlying rate of inflation is much lower than in the US, UK or New Zealand. It also happens to be in the middle of the bank’s 2-3 per cent target band.

This might be because inflation has been well below the Reserve Bank’s target band for the past half-decade.

Underlying inflation

Addressing the National Press Club on Wednesday, Philip Lowe said he expects Australia’s gross domestic product to continue growing at a rapid rate in the year ahead, around 4.5 per cent. He also sees unemployment to continue falling – down to as little as 3.75 per cent by the end of this year.

He expects underlying inflation to peak at just over 3 per cent, before returning to the 2-3 per cent target band.

Better than before

What explains this optimistic outlook? In many ways, the economy of 2022 resembles a return to normality.

Experts expect the Omicron wave to continue to diminish and the rollout of vaccine boosters and new anti-viral drugs to push COVID into Australia’s rear-view mirror.

This means Australia slowly returning to its pre-pandemic state with open borders and no lockdowns and restrictions.

It would also mean returning to the sub-par economic growth of 2-2.5 per cent we had before COVID, were it not for two things.

One is what the crisis did in forcing the government to end its budget surplus fetish and spexjmtzywnd to support the economy.

The other is what it did in persuading the Reserve Bank to rekindle its pursuit of full employment.

Before the pandemic, the bank worried excessively about the risks low interest rates posed to financial stability. Today, it rightly prioritises supporting the labour market.

These twin developments mean the 2022 economy is being supported by two coordinated boosters.

Combined, monetary (interest rate) stimulus and fiscal (budget spending) stimulus has pushed the unemployment rate well below 5 per cent and will continue pushing it down over the months to come.

Dr Lowe finished his speech turning to monetary policy and how it might unfurl over the year to come.

The bank has finished its use of unconventional monetary policies – bond-buying measures such as “yield curve control” and “quantitative easing”. But it remains committed to keeping its cash rate at the current low of 0.1 per cent for a while yet.

So why keep interest rates low?

Why keep interest rates so low if the outlook is so positive? The governor put forward two reasons.

One is that, while the bank has an optimistic outlook for 2022, there is still a great deal of uncertainty around what the year will bring.

The bank wants to make sure these gains are locked in before it takes its foot off the accelerator. The costs of overheating the economy are relatively minor compared to what would happen if it hit the brakes too early and a new variant of COVID tipped the economy back into a recession.